Replication of Mackowiak, Matejka and Wiederholt (2018)

This example replicates Mackowiak, Matejka and Wiederholt (2018) using the DRIPs package.

to run and modify the following code (no software is needed on the local machine).

See Afrouzi and Yang (2020) for background on the theory.

Contents

- Ex. 1: AR(2) Process

- Ex. 2: AR(3) and ARMA(2,1) Processes

- Ex. 3: Price-setting with Rational Inattention

- Ex. 4: Business Cycle Model with News Shocks

Ex. 1: AR(2) Process

In this example, authors assume that the optimal action follows an AR(2) process,

Then, we can write a state-space form as:

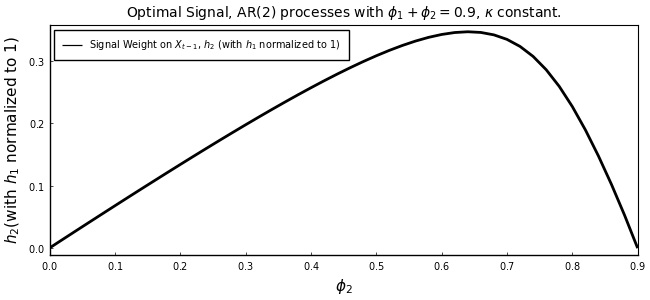

We now characterize the optimal signal, $S_{t} = h_1 X_t + h_2 X_{t-1} + \psi_t$, as a function of $\phi_2$ and the capacity for information processing ($\kappa$).

Initialization

Include the package:

using DRIPs, LinearAlgebra;

nothing #hideAssign value to deep parameters and define the structure of the problem

β = 1.0 ; # Time preference

θ0 = 1.0 ;

ϕ2_seq = 0:0.02:0.9 ; # sequence of values for the AR(2) parameter

n_ϕ = length(ϕ2_seq) ;

κ_seq = 0.008:0.01:3.5 ; # sequence of values for the information processing capacity

n_κ = length(κ_seq) ;

H = [1; 0] ;

Q = [θ0 ; 0] ;

nothing #hideReplication of Figures (2) and (3)

Solve for different values of $\phi_2$:

κ = 0.2 ; # fix κ for this exercise so we can vary ϕ2

h1 = zeros(n_ϕ,1) ;

h2 = zeros(n_ϕ,1) ;

h2norm = zeros(n_ϕ,1) ;

for i in 1:n_ϕ

ϕ2 = ϕ2_seq[i] ;

ϕ1 = 0.9 - ϕ2 ;

A = [ϕ1 ϕ2 ; 1.0 0.0] ;

ex1a = Drip(κ,β,A,Q,H,fcap=true);

h1[i] = ex1a.ss.Y[1]

h2[i] = ex1a.ss.Y[2]

h2norm[i] = ex1a.ss.Y[2]/ex1a.ss.Y[1] # normalize the first signal weight h1 to one

endHere is the replication of Figure (2):

using Printf, LaTeXStrings, Plots; pyplot();

plot(ϕ2_seq,h2norm[:,1],

title = L"Optimal Signal, AR(2) processes with $\phi_1 + \phi_2 = 0.9$, $\kappa$ constant.",

xlabel = L"$\phi_2$",

ylabel = L"$h_2$(with $h_1$ normalized to 1)",

label = L"Signal Weight on $X_{t-1}$, $h_2$ (with $h_1$ normalized to 1)",

legend = :topleft,

lw = 2,

color = :black,

xlim = (0,0.9),

xticks = (0:0.1:0.9),

titlefont = font(10), legendfont = font(7), tickfont = font(7),

size = (650,300),

grid = :off, framestyle = :box)

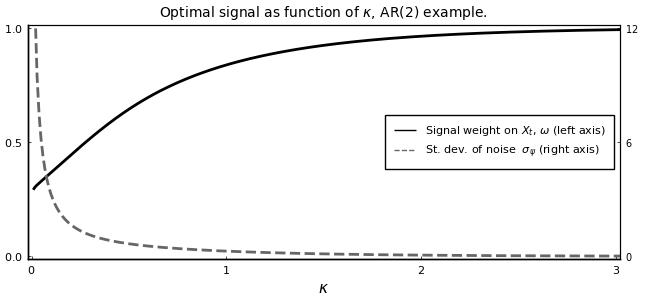

Now, we solve for the signal weight and standard deviation of noise, for different values of $\kappa$

ϕ2 = 0.4 ; # fix ϕ2 in this exercise so we can vary κ

ϕ1 = 0.99 - ϕ2 ;

A = [ϕ1 ϕ2 ; 1.0 0.0] ;

ω_sol = zeros(n_κ,1) ;

σz_sol = zeros(n_κ,1) ;

for i in 1:n_κ

κ = κ_seq[i] ;

ex1b = Drip(κ,β,A,Q,H,fcap=true);

h1temp = ex1b.ss.Y[1]

h2temp = ex1b.ss.Y[2]

ω_sol[i] = 1.0 - (h2temp/h1temp)/(ϕ2 + (1.0-ϕ1)*(h2temp/h1temp)) ;

ρ = (ω_sol[i] + (1.0-ω_sol[i])*ϕ1)/h1temp

σz_sol[i] = ρ*ex1b.ss.Σ_z[1,1] ;

endBelow is the replication of Figure (3):

a = fill(NaN, n_κ, 1)

plot(κ_seq,[ω_sol[:,1] a],

xlabel = L"$\kappa$",

label = [L"Signal weight on $X_{t}$, $\omega$ (left axis)" L"St. dev. of noise $\sigma_{\psi}$ (right axis)"],

title = L"Optimal signal as function of $\kappa$, AR(2) example.",

linestyle = [:solid :dash], color = [:black :gray40],

xticks = (0:1:3),

xlim = (-0.02,3.02),

yticks = (0:0.5:1),

ylim = (-0.01,1.01),

lw = 2, grid = :off, legend = :right,

titlefont = font(10), legendfont = font(8), tickfont = font(8),

framestyle = :box)

plot!(twinx(),κ_seq,σz_sol[:,1],

linestyle = :dash, color = :gray40,

label = "",

xlim = (-0.02,3.02),

xticks = false,

yticks = (0:6:12),

ylim = (-0.12,12.12),

lw = 2, tickfont = font(7),

size = (650,300),

grid = :off, framestyle = :box)

Measure Performance

Benchmark the solution for random values of $\phi_2$:

using BenchmarkTools;

@benchmark Drip(κ,β,[0.9-ϕ2 ϕ2; 1.0 0.0],Q,H,fcap = true) setup = (ϕ2 = 0.9*rand())BenchmarkTools.Trial:

memory estimate: 431.52 KiB

allocs estimate: 4150

--------------

minimum time: 208.853 μs (0.00% GC)

median time: 248.778 μs (0.00% GC)

mean time: 305.579 μs (18.04% GC)

maximum time: 6.972 ms (95.35% GC)

--------------

samples: 10000

evals/sample: 1Benchmark the solution for random values of $κ$:

@benchmark Drip(κ,β,[0.5 0.4; 1.0 0.0],Q,H,fcap = true) setup = (κ = rand())BenchmarkTools.Trial:

memory estimate: 74.66 KiB

allocs estimate: 729

--------------

minimum time: 40.597 μs (0.00% GC)

median time: 121.589 μs (0.00% GC)

mean time: 215.463 μs (18.02% GC)

maximum time: 7.279 ms (91.38% GC)

--------------

samples: 10000

evals/sample: 1Ex. 2: AR(3) and ARMA(2,1) Processes

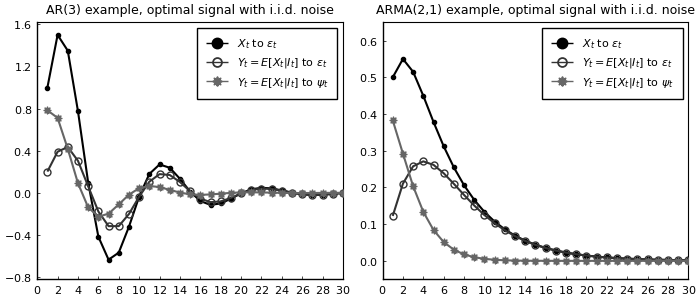

Here, we replicate the AR(3) and ARMA(2,1) examples in Mackowiak, Matejka and Wiederholt (2018). Using a similar method to the AR(2) case, we can write the law of motion of optimal actions as a state-space form.

Solve and Meausre Performance

The AR(3) Example

Initialize:

β = 1.0 ;

θ0 = 1.0 ;

κ = 10.8 ;

ϕ1 = 1.5 ;

ϕ2 = -0.9 ;

ϕ3 = 0.1 ;

A = [ϕ1 ϕ2 ϕ3 ; 1 0 0 ; 0 1 0] ;

Q = [θ0 ; 0; 0] ;

H = [1 ; 0; 0] ;

nothing #hideSolve:

ex2a = Drip(κ,β,A,Q,H;tol=1e-8);

nothing #hideMeasure performance for different values of $\kappa$:

@benchmark Drip(κ,β,A,Q,H;tol=1e-8) setup = (κ = 10*rand())BenchmarkTools.Trial:

memory estimate: 147.59 KiB

allocs estimate: 1044

--------------

minimum time: 150.313 μs (0.00% GC)

median time: 554.403 μs (0.00% GC)

mean time: 578.350 μs (7.45% GC)

maximum time: 5.389 ms (83.21% GC)

--------------

samples: 8625

evals/sample: 1To be consistent with MMW(2018), scale the signal vector so that the weight on the first element is one ($h_1 = 1$):

h1 = 1;

h2 = ex2a.ss.Y[2]/ex2a.ss.Y[1]

h3 = ex2a.ss.Y[3]/ex2a.ss.Y[1]0.05349220551890679Print the weights:

s = @sprintf(" h1 = %5.3f, h2 = %5.3f, h3 = %5.3f", h1, h2, h3) ;

println(s) ;

nothing #hide h1 = 1.000, h2 = -0.475, h3 = 0.053

Since we scaled the signal vector, we also need to adjust the noise in the signal accordingly:

AdjNoise = 3.879

AdjPara_ex2a= AdjNoise*ex2a.ss.Y[1]0.7839654755293674Calculate IRFs:

irf_ex2a = irfs(ex2a; T=30) ;

xirf_ex2a = irf_ex2a.x[1,1,:]

xhatirf_ex2a= irf_ex2a.x_hat[1,1,:]

x = zeros(3,30);

xhat_noise_ex2a = zeros(3,30);

for ii in 1:30

if ii==1

xhat_noise_ex2a[:,ii] = ex2a.ss.K;

else

xhat_noise_ex2a[:,ii] = A*xhat_noise_ex2a[:,ii-1]+(ex2a.ss.K*ex2a.ss.Y')*(x[:,ii]-A*xhat_noise_ex2a[:,ii-1]);

end

end

xhat_noise_ex2a = xhat_noise_ex2a[1,:]*AdjPara_ex2a ;

nothing #hideThe ARMA(2,1) Example:

Initialize:

β = 1.0 ;

θ0 = 0.5 ;

θ1 = -0.1 ;

κ = 1.79 ;

ϕ1 = 1.3 ;

ϕ2 = -0.4 ;

A = [ϕ1 ϕ2 θ1 ; 1.0 0.0 0.0 ; 0.0 0.0 0.0] ;

Q = [θ0 ; 0.0; 1.0] ;

H = [1.0; 0.0; 0.0] ;

nothing #hideSolve:

ex2b = Drip(κ,β,A,Q,H,tol=1e-8);

nothing #hideMeasure performance for different values of $\kappa$:

@benchmark Drip(κ,β,A,Q,H;tol=1e-8) setup = (κ = 2*rand())BenchmarkTools.Trial:

memory estimate: 109.88 KiB

allocs estimate: 777

--------------

minimum time: 116.629 μs (0.00% GC)

median time: 400.173 μs (0.00% GC)

mean time: 418.805 μs (6.45% GC)

maximum time: 5.120 ms (87.81% GC)

--------------

samples: 10000

evals/sample: 1To be consistent with MMW(2018), scale the signal vector so that the weight on the first element is one ($h_1 = 1$):

h1 = 1;

h2 = ex2b.ss.Y[2]/ex2b.ss.Y[1]

h3 = ex2b.ss.Y[3]/ex2b.ss.Y[1]-0.0687478067895003Print the weights:

s = @sprintf(" h1 = %5.3f, h2 = %5.3f, h3 = %5.3f", h1, h2, h3) ;

println(s) ;

nothing #hide h1 = 1.000, h2 = -0.275, h3 = -0.069

Since we scaled the signal vector, we also need to adjust the noise in the signal accordingly:

AdjNoise = 1.349

AdjPara_ex2b= AdjNoise*ex2b.ss.Y[1]0.3828466148956306Calculate the IRFs

irf_ex2b = irfs(ex2b; T=30) ;

xirf_ex2b = irf_ex2b.x[1,1,:]

xhatirf_ex2b = irf_ex2b.x_hat[1,1,:]

x = zeros(3,30);

xhat_noise_ex2b = zeros(3,30);

for ii in 1:30

if ii==1

xhat_noise_ex2b[:,ii] = ex2b.ss.K;

else

xhat_noise_ex2b[:,ii] = A*xhat_noise_ex2b[:,ii-1]+(ex2b.ss.K*ex2b.ss.Y')*(x[:,ii]-A*xhat_noise_ex2b[:,ii-1]);

end

end

xhat_noise_ex2b = xhat_noise_ex2b[1,:]*AdjPara_ex2b ;

nothing #hideReplication of Figure (5)

p1 = plot(1:30,[xirf_ex2a xhatirf_ex2a xhat_noise_ex2a],

title = "AR(3) example, optimal signal with i.i.d. noise",

color = [:black :gray20 :gray40], markerstrokecolor = [:black :gray20 :gray40],

yticks = (-0.8:0.4:1.6),

ylim = (-0.82,1.62))

p2 = plot(1:30,[xirf_ex2b xhatirf_ex2b xhat_noise_ex2b],

title = "ARMA(2,1) example, optimal signal with i.i.d. noise",

color = [:black :gray20 :gray40], markerstrokecolor = [:black :gray20 :gray40],

yticks = (0:0.1:0.6),

ylim = (-0.05,0.65))

Plots.plot(p1,p2,

layout = (1,2),

label = [L"$X_{t}$ to $\varepsilon_t$" L"$Y_t=E[X_t|I_t]$ to $\varepsilon_t$" L"$Y_t=E[X_t|I_t]$ to $\psi_t$"],

marker = [:circle :circle :star8], markercolor = [:black :false :gray40], markersize = [3 5 5],

legend = :topright,

xticks = (0:2:30),

xlim = (0,30),

lw = 1.5,

legendfont = font(8), guidefont=font(9), titlefont=font(9), tickfont=font(8),

size = (700,300),

grid = :off, framestyle = :box)

Ex. 3: Price-setting with Rational Inattention

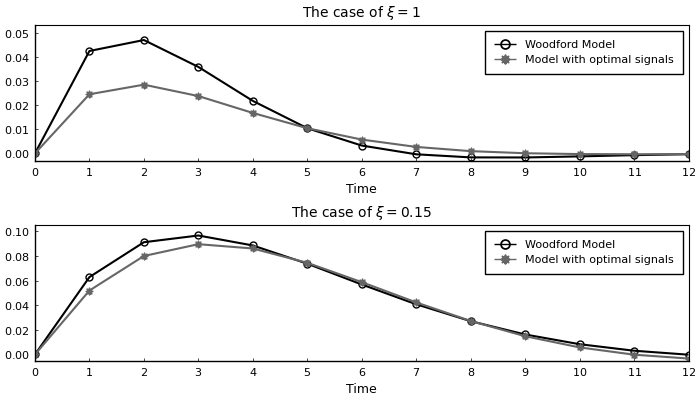

We now replicate the price-setting exercise in MMW (2018) and its comparison with the Woodford (2002) example. This corresponds to Figure (6) in their paper. The model structure is identifcal to our Example 1 (without strategic complementarity) and Example 2 (with strategic complementarity).

The Case with No Strategic Complementarity

Initialize:

ρ = 0.9; #persistence of money growth

σ_u = 0.1; #std. deviation of shocks to money growth

nothing #hidePrimitives of the DRIP:

κ = 0.62;

β = 1.0;

A = [1 ρ; 0 ρ];

Q = σ_u*[1; 1];

H = [1; 0];

ω = 0.10.1Solve:

ex_opt = Drip(κ,β,A,Q,H,fcap=true);

capa_opt = DRIPs.capacity(ex_opt) #returns capacity utilized in bits0.6196339094366835Measure performance for different values of $\kappa$:

@benchmark Drip(κ,β,A,Q,H,fcap=true) setup = (κ = 2*rand())BenchmarkTools.Trial:

memory estimate: 206.02 KiB

allocs estimate: 1988

--------------

minimum time: 104.888 μs (0.00% GC)

median time: 209.835 μs (0.00% GC)

mean time: 427.268 μs (18.40% GC)

maximum time: 31.527 ms (21.48% GC)

--------------

samples: 10000

evals/sample: 1Calculate IRFs:

irfs_ex_opt = irfs(ex_opt, T = 12);

output_opt = (irfs_ex_opt.x[1,1,:] - irfs_ex_opt.a[1,1,:]) ;

output_opt = [0;output_opt] ;

nothing #hideNow, to compare with Woodford (2002), assume that firms observe a noisy signal, $S_t = q_t + \zeta_t$ where $\zeta_t$ is an idiosyncratic noise. We first define a function to solve the corresponding Kalman filtering problem.

function K_filtering(A,Q,Ysignal,Σz,Σ0 ; maxit=10000,tol=1e-10,w=1)

err = 1

iter = 0

while (err > tol) & (iter < maxit)

global Knew = Σ0*Ysignal*inv(Ysignal'*Σ0*Ysignal .+ Σz)

global Σp_temp = Σ0 - Knew*Ysignal'*Σ0

global Σ1 = A*Σp_temp*A' + Q*Q'

err = norm(Σ1 - Σ0,2)/norm(Σ0,2)

Σ0 = w*Σ1 + (1-w)*Σ0

#println("Iteration $iter. Difference: $err")

iter += 1

end

return(Knew,Σ0,Σp_temp)

end;

nothing #hideNow find the capacity utilized under Woodford’s formulation such that it yields the same information flow as the optimal signal under ratinoal inattention.

Ywoodford = [1;0]

Σ1_init = ex_opt.ss.Σ_1

Σz_new_b = 0.01

Σz_new_u = 0.1

Σz_new = (Σz_new_b+Σz_new_u)/2

for i in 1:10000

(Knew,Σ1_new,Σp_temp) = K_filtering(A,Q,Ywoodford,Σz_new,Σ1_init;w=0.5)

capa_woodford = 0.5*log(det(Σ1_new)/det(Σp_temp))/log(2)

if capa_woodford > capa_opt

global Σz_new_b = Σz_new

else

global Σz_new_u = Σz_new

end

global Σz_new = (Σz_new_b+Σz_new_u)/2

err = abs(capa_woodford - capa_opt)

if err < 1e-5

break

end

endCalculate impulse responses under Woodford's formulation

e_k = 1;

x = zeros(2,12);

xhat= zeros(2,12);

a = zeros(2,12);

for ii in 1:12

if ii==1

x[:,ii] = Q*e_k;

xhat[:,ii] = (Knew*Ywoodford')*(x[:,ii]);

else

x[:,ii] = A*x[:,ii-1];

xhat[:,ii] = A*xhat[:,ii-1]+(Knew*Ywoodford')*(x[:,ii]-A*xhat[:,ii-1]);

end

a[:,ii] .= H'*xhat[:,ii];

end

output_woodford = (x[1,:] - a[1,:]) ;

output_woodford = [0;output_woodford] ;

nothing #hideBefore plotting the IRFs, we also solve the case with strategic complementarity.

The Case with Strategic Complementarity

We now turn to the example with strategic complementarity. As in our Example 2, we first define a function to solve the fixed point with endogenous feedback.

function ge_drip(ω,β,A,Q, #primitives of drip except for H because H is endogenous

α, #strategic complementarity

Hq, #state space rep. of Δq

L; #length of truncation

H0 = Hq, #optional: initial guess for H (Hq is the true solution when α=0)

maxit = 200, #optional: max number of iterations for GE code

tol = 1e-4) #optional: tolerance for iterations

err = 1;

iter = 0;

M = [zeros(1,L-1) 0; Matrix(I,L-1,L-1) zeros(L-1,1)];

while (err > tol) & (iter < maxit)

if iter == 0

global ge = Drip(ω,β,A,Q,H0; w=0.9);

else

global ge = Drip(ω,β,A,Q,H0; Ω0=ge.ss.Ω, Σ0=ge.ss.Σ_1, maxit=100);

end

XFUN(jj) = ((I-ge.ss.K*ge.ss.Y')*ge.A)^jj * (ge.ss.K*ge.ss.Y') * (M')^jj

X = DRIPs.infinitesum(XFUN; maxit=L, start = 0); #E[x⃗]=X×x⃗

XpFUN(jj) = α^jj * X^(jj)

Xp = DRIPs.infinitesum(XpFUN; maxit=L, start = 0);

H1 = (1-α)*Xp'*Hq;

err= 0.5*norm(H1-H0,2)/norm(H0)+0.5*err;

H0 = H1;

iter += 1;

if iter == maxit

print("GE loop hit maxit\n")

elseif mod(iter,10) == 0

println("Iteration $iter. Difference: $err")

end

end

print(" Iteration Done.\n")

return(ge)

end;

nothing #hideNow, we solve for the optimal signal structure under rational inattention.

Initialize:

ρ = 0.9; #persistence of money growth

σ_u = 0.1; #std. deviation of shocks to money growth

α = 0.85; #degree of strategic complementarity

L = 40; #length of truncation

Hq = ρ.^(0:L-1); #state-space rep. of Δq

ω = 0.08;

β = 1 ;

A = [1 zeros(1,L-2) 0; Matrix(I,L-1,L-1) zeros(L-1,1)];

M = [zeros(1,L-1) 0; Matrix(I,L-1,L-1) zeros(L-1,1)]; # shift matrix

Q = [σ_u; zeros(L-1,1)];

nothing #hideSolve:

ex_ge = ge_drip(ω,β,A,Q,α,Hq,L) ;

nothing #hideIteration 10. Difference: 0.0019552334926346503

Iteration Done.

Print capacity utilized in with strategic complementarity:

capa_ge = DRIPs.capacity(ge)0.5830085573346633Measure performance for random values of ω

using Suppressor

@suppress @benchmark ge_drip(ω,β,A,Q,α,Hq,L) setup = (ω = 0.1*rand())BenchmarkTools.Trial:

memory estimate: 348.71 MiB

allocs estimate: 43486

--------------

minimum time: 283.261 ms (7.39% GC)

median time: 290.786 ms (7.18% GC)

mean time: 294.165 ms (7.51% GC)

maximum time: 317.900 ms (7.65% GC)

--------------

samples: 17

evals/sample: 1Calculate IRFs

geirfs = irfs(ex_ge,T = L) ;

dq = diagm(Hq)*geirfs.x[1,1,:];

q = inv(I-M)*dq ;

output_ge_opt = q - geirfs.a[1,1,:] ;

output_ge_opt = [0;output_ge_opt] ;

nothing #hideFinally, to compare with the IRFs under Woodford (2002)’s specification, we find signal noise such that it yields the same information flow as the optimal signal structure.

Ywoodford_ge = Hq

Σ1_init = ex_ge.ss.Σ_1

Σz_new_b = 0.05

Σz_new_u = 0.12

Σz_new = (Σz_new_b+Σz_new_u)/2

for i in 1:10000

(Knew,Σ1_new,Σp_temp) = K_filtering(A,Q,Ywoodford_ge,Σz_new,Σ1_init;w=0.5)

capa_woodford = 0.5*log(det(Σ1_new)/det(Σp_temp))/log(2)

if capa_woodford > capa_ge

global Σz_new_b = Σz_new

else

global Σz_new_u = Σz_new

end

global Σz_new = (Σz_new_b+Σz_new_u)/2

err = abs(capa_woodford - capa_ge)

if err < 1e-5

break

end

end

XFUN(jj) = ((I-Knew*Ywoodford_ge')*A)^jj * (Knew*Ywoodford_ge') * (M')^jj

X = DRIPs.infinitesum(XFUN; maxit=L, start = 0); #E[x⃗]=X×x⃗

XpFUN(jj) = α^jj * X^(jj)

Xp = DRIPs.infinitesum(XpFUN; maxit=L, start = 0);

H1 = (1-α)*Xp'*Hq;

nothing #hideCalculate impurse responses under Woodford's signal

e_k = 1;

x = zeros(40,40);

xhat= zeros(40,40);

a = zeros(1,40);

for ii in 1:40

if ii==1

x[:,ii] = Q*e_k;

xhat[:,ii] = (Knew*Ywoodford_ge')*(x[:,ii]);

else

x[:,ii] = A*x[:,ii-1];

xhat[:,ii] = A*xhat[:,ii-1]+(Knew*Ywoodford_ge')*(x[:,ii]-A*xhat[:,ii-1]);

end

a[:,ii] .= H1'*xhat[:,ii];

end

dq = diagm(Hq)*x[1,:];

q = inv(I-M)*dq ;

output_ge_woodford = q - a[1,:] ;

output_ge_woodford = [0;output_ge_woodford] ;

nothing #hideWe now have all the IRFs to replicate Figure (6)

Replication of Figure (6)

p1 = plot(0:12,[output_woodford output_opt],

title = L"The case of $\xi=1$",

color = [:black :gray40], markerstrokecolor = [:black :gray40],

ylim = (-0.003,0.053),

ytick = (0:0.01:0.05))

p2 = plot(0:12,[output_ge_woodford[1:13] output_ge_opt[1:13]],

title = L"The case of $\xi=0.15$",

color = [:black :gray40], markerstrokecolor = [:black :gray40],

ylim = (-0.005,0.105),

ytick = (0:0.02:0.1))

Plots.plot(p1,p2,

layout = (2,1),

label = ["Woodford Model" "Model with optimal signals"],

legend = :topright,

marker = [:circle :star8], markersize = [5 5], markercolor = [:false :gray40],

xlim = (0,12),

xtick = (0:1:12),

xlabel = "Time",

lw = 1.5,

legendfont = font(8), titlefont = font(10), guidefont = font(9), tickfont = font(8),

size = (700,400),

grid = :off, framestyle = :box)

Ex. 4: Business Cycle Model with News Shocks

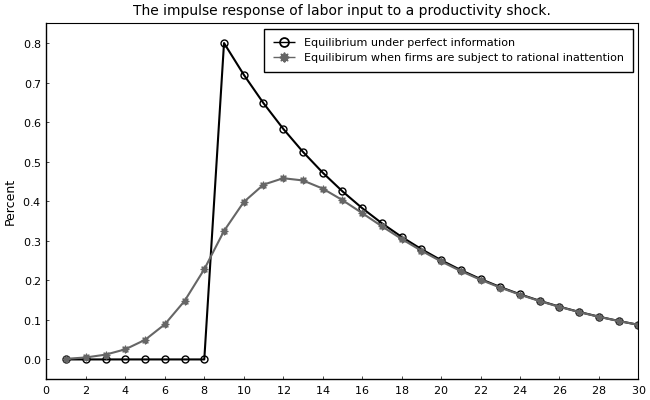

In this section, we replicate the business cycle model with news shocks in Section 7 in Mackowiak, Matejka and Wiederholt (2018).

Setup

Full-Information

The techonology shock follows AR(1) process:

and the total labor input is:

Under perfect information, the households chooses the utility-maximizing labor supply, all firms choose the profit-maximizing labor input, and the labor market clearing condition is:

Then, the market clearing wages and the equilibrium labor input are:

Rational Inattention

Firms wants to keep track of their ideal price,

where $n_{t} = \int_0^1 n_{i,t} di$. Then, firm $i$'s choice depends on its information set at time $t$:

Note that now the state space representation for $n_{t}^*$ is determined in the equilibrium. However, we know that this is a Guassian process and by Wold's theorem we can decompose it to its $MA(\infty)$ representation:

where $\Phi(.)$ is a lag polynomial and $\varepsilon_t$ is the shock to technology. Here, we have basically guessed that the process for $p_{i,t}^*$ is determined uniquely by the history of monetary shocks which requires that rational inattention errors of firms are orthogonal (See Afrouzi (2020)). Our objective is to find $\Phi(.)$.

Now, as in our Example 2, we can represent the problem in a matrix notation.

Initialization

β = 1 ; # Time preference

γ = 1/3 ; # Inverse of intertemporal elasticity of substitution

ψ = 0 ; # Inverse of Frisch elasticity

α = 3/4 ; # Labor share in production function

θ = -1/α*(ψ+γ)/(1-γ) ;

ξ = θ/(θ-1) ;

ρ = 0.9 ; #persistence of technology shocks

σ = 1 ; #std. deviation of technology shocks

ω = 6.5 ; # Information cost

L = 40 ; #length of truncation

k = 8 ; #news horizon

M = [zeros(1,L-1) 0; Matrix(I,L-1,L-1) zeros(L-1,1)]; # shift matrix

Hz = ρ.^(0:L-1)

Hz = (M^k)*Hz

A = M ;

Q = [σ; zeros(L-1,1)] ;

nothing #hideAlso, define a function that solves the GE problem and returns the solution in a Drip structure:

function ge_drip(ω,β,A,Q, #primitives of drip except for H because H is endogenous

α, #strategic complementarity

θ,

Hz, #state space rep. of z

L; #length of truncation

w_out = 0.5, #optional: initial guess for H (Hq is the true solution when α=0)

H0 = Hz, #optional: initial guess for H (Hq is the true solution when α=0)

maxit = 200, #optional: max number of iterations for GE code

tol = 1e-6) #optional: tolerance for iterations

err = 1;

iter = 0;

M = [zeros(1,L-1) 0; Matrix(I,L-1,L-1) zeros(L-1,1)];

eye = Matrix(I,L,L)

while (err > tol) & (iter < maxit)

if iter == 0

global ge = Drip(ω,β,A,Q,H0;w=0.5, tol=1e-8);

else

global ge = Drip(ω,β,A,Q,H0;w=0.9, tol=1e-8, Ω0=ge.ss.Ω, Σ0=ge.ss.Σ_1, maxit=1000);

end

XFUN(jj) = ((eye-ge.ss.K*ge.ss.Y')*ge.A)^jj * (ge.ss.K*ge.ss.Y') * (M')^jj

X = DRIPs.infinitesum(XFUN; maxit=L, start = 0); #E[x⃗]=X×x⃗

H1 = (1/α)*Hz + θ*X'*H0 ;

err= 0.5*norm(H1-H0,2)/norm(H0)+0.5*err;

H0 = w_out*H1 + (1.0-w_out)*H0 ;

iter += 1;

if iter == maxit

print("GE loop hit maxit\n")

elseif mod(iter,10) == 0

println("Iteration $iter. Difference: $err")

end

end

print(" Iteration Done.\n")

return(ge)

end;

nothing #hideSolve and Measure Performance

Solve:

ge = ge_drip(ω,β,A,Q,α,θ,Hz,L) ;

nothing #hideIteration 10. Difference: 0.008423206111917462

Iteration 20. Difference: 1.1340049707814608e-5

Iteration Done.

Measure performance by solving the model for different values of ω:

@suppress @benchmark ge_drip(ω,β,A,Q,α,θ,Hz,L) setup = (ω = 6.5*rand())BenchmarkTools.Trial:

memory estimate: 597.88 MiB

allocs estimate: 82340

--------------

minimum time: 596.296 ms (6.48% GC)

median time: 672.290 ms (6.01% GC)

mean time: 677.960 ms (5.97% GC)

maximum time: 775.863 ms (5.46% GC)

--------------

samples: 8

evals/sample: 1Calculate IRFs and profit loss:

geirfs = irfs(ge,T = L) ;

profit_loss = sum((geirfs.x[1,1,:]/100 - geirfs.x_hat[1,1,:]/100).^2) ;

s = @sprintf("==: Profit loss from rational inattention = %6.5f", profit_loss) ;

println(s) ;

nothing #hide==: Profit loss from rational inattention = 0.00010

Replication of Figure (7)

n_opt = geirfs.a[1,1,:] ; # Optimal labor input under rational inattention

n_fullinfo = σ*1/α*(1-ξ)*Hz ; # Optimal labor input under full information

plot(1:30,[n_fullinfo[1:30] n_opt[1:30]],

title = "The impulse response of labor input to a productivity shock.",

ylabel = "Percent",

label = ["Equilibrium under perfect information" "Equilibirum when firms are subject to rational inattention"],

legend = :topright,

color = [:black :gray40], markerstrokecolor = [:black :gray40],

marker = [:circle :star8], markercolor = [:false :gray40], markersize = [5 5],

ylim = (-0.05,0.85),

ytick = (0:0.1:0.8),

xlim = (0,30),

xtick = (0:2:30),

lw = 1.5,

legendfont = font(8), titlefont = font(10), tickfont = font(8), guidefont = font(9),

size = (650,400),

grid = :off, framestyle = :box)

This page was generated using Literate.jl.